Current Issues for franchise accountants

/ What do franchise accountants talk about when they get together? Top of the list at a recent gathering of FAN members were franchise payroll issues and pre-purchase advice.

Here's a recap of the issues we covered at our meeting on 19th August 2016.

What do franchise accountants talk about when they get together? Top of the list at a recent gathering of FAN members were franchise payroll issues and pre-purchase advice.

Here's a recap of the issues we covered at our meeting on 19th August 2016.

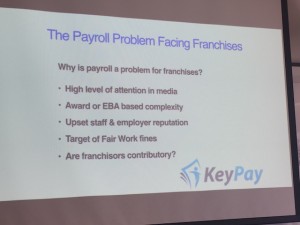

The Payroll Problem

Garth Belic and Richard McLean from Keypay spoke about the state of play regarding wages compliance in franchising, and payroll solutions that accountants can offer franchise clients. Garth pointed out the reality that it is difficult for franchise owners to get payroll right if they rely on spreadsheets, manual entry of wage rates and allowances, and data entry from time and attendance records.

The franchise accountants agreed that this is a great challenge for many small business clients. After a robust discussion the feeling was that, while MYOB and Xero meet the needs of some, for many in the franchise sector an 'end to end' payroll solution (such as Keypay) is the way to reduce risk of non-compliance and improve audit trails.

Franchise Resales

Matthew Page from Link Brokers spoke about the franchise resale market. One of the key take aways was that expert advice is vital to avoid making costly mistakes when you buy a franchise. Matthew also pointed out the risks to franchise business values when a brand over-expands or when there are financial concerns within the business.

Franchisor Insight

The Franchisor Insight session is one of the most popular items on the agenda when FAN members meet. This one was no exception, with a thorough and informative talk by Mark Zilm about the Refresh Renovations franchise.

The purpose of this segment is to introduce accountants to the various franchises in the market, and help them understand the model and financial issues. This helps the accountants provide relevant advice and insights to prospective and established franchisees.

Pre-purchase Reviews

Several speakers highlighted the importance of prospective franchisees obtaining an independent pre-purchase review of the financial side of their chosen franchise.

Following work done by Peter Knight and Rob McAdam, members of the group learned about a tool to help them provide streamlined advice to prospective franchisees.

Financial Stress

Not all franchise businesses go well. With this in mind, Peter McLaughlin (Redchip) spoke about recent cases where franchisees have found themselves in financial stress. Shabnam Amirbeaggi (Crouch Amirbeaggi) highlighted some of the franchise insolvency cases she has dealt with, and pointed out that early intervention can often help.

The day closed with information about the upcoming Franchise Accountants Conference.

Thanks also to Bentley's Accountants NSW for hosting our meeting.